Table of Contents

Since the advent of digital assets, crypto futures have arguably been one of the most interesting trading vehicles. They have fostered an interest in the cryptocurrency field outside of the business by enabling speculative exposure, broadening its appeal, and promoting acceptance.

This fascination is so pervasive that it has enchanted even the most illustrious financial behemoths, such as the Intercontinental Exchange (ICE). Last year, ICE unveiled its version of cryptocurrency futures in partnership with Bakkt, sparking further industry interest.

Also Read:

Explanation of Cryptocurrency Futures

Cryptocurrency futures are classified as Derivative Products. These items constitute a kind of contract. Futures are essentially agreements between two parties to acquire or sell an asset on a particular date and at a defined price. The contract is linked to an underlying, which is a Digital Token in the case of a cryptocurrency futures contract.

Futures contracts are fundamentally a gamble. They allow traders to speculate on an asset’s future value. Participants may go long, betting on a price gain or short, betting on a price decline. Long-term traders agree to purchase the asset on a certain date, whereas short-term traders commit to selling the item on the same day. When the contract’s expiry date approaches, the parties settle, closing the deal.

Additionally, certain futures markets allow leverage, a tactic in which traders borrow money to finance the contracts. In brief, use grants to access greater holdings without having to finance the position in advance. Traders who use leverage are not required to match the contract’s entire value.

Rather than that, they may use their position to acquire a contract with minimal equity participation; this is an initial margin. If the trader’s position moves against him, he must adhere to a certain maintenance margin to keep the position open. If this level is breached, the trade is liquidated.

Leverage thresholds vary per exchange. For example, iFinex Financial Technologies Limited (“Bitfinex”) provides 100x leverage. It is equivalent to USDT 100 for each USDT pledged in equity by the trader, which also applies to the Tether Gold/Tether pair.

Fundamentals of Futures Trading

Futures contracts are best described via a case study. Assume that a crypto asset’s price is USDT 1,000. A trader feels the asset’s value will improve and seeks to purchase five futures contracts.

This increases the value of the position to USDT 5,000. The trader was correct, and each contract is now valued at USDT 2,000. The trader may now sell the five futures for a total of USDT 10,000, earning USDT 5,000 in profit.

The same principle applies to shorts. Instead of purchasing, the trader sells five futures contracts at the cost of USDT 1,000 each, for a total position value of USDT 5000. Following a USDT 500 price decline, the trader repurchases the initial five contracts for a total of USDT 2,500, pocketing the difference.

For others, his approach may be more appealing than simply purchasing Digital Tokens. First, a big barrier to admission is the rather confusing way Digital Tokens are stored.

This obstacle is minimized in futures trading since the exchange provides proper custody, and in many situations, futures contracts are cash-settled, obviating the need for custodial services entirely.

Another factor is that institutional traders are involved. These traders are significantly more at ease trading a Derivative Product since the futures trading regulations in conventional financial markets are almost identical to those on a Digital Token exchange.

For expert traders, crypto futures provide an intriguing hedging opportunity. Traders already exposed to Digital Tokens might protect themselves against price volatility by acquiring an opposing position in the futures contract.

Additionally, futures provide customers with a capital-efficient alternative to obtain market exposure to crypto-assets. The risk of loss is already accounted for since collateral is established at position entry.

Additionally, futures enable traders to use a carry strategy by obtaining capital.

How to Get Involved in the Futures Market?

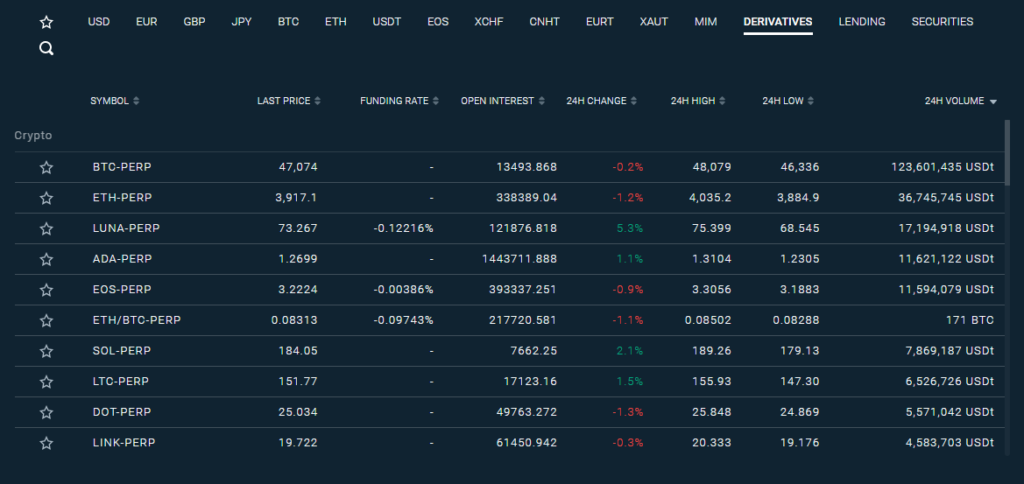

Trading Derivative Products is quite simple on Bitfinex’s Derivative Site*. Bitfinex provides what is known as a perpetual contract for trading Digital Token futures. Perpetual contracts, as their name implies, have no expiration date, allowing traders to retain a position eternally if they can finance it.

To begin trading, customers must load USD into their Derivative Wallet. This needs a currency conversion from USDT to USD, which may be accomplished through the wallets page’s ‘currency conversion’ function. Once converted, users may select between long or short positions.

Users may open a position by visiting the derivatives page and selecting their desired Digital Token pairings. From there, it’s just a question of selecting the quantity, pricing, and order type – sell or purchase – for the transaction. Users seeking leverage may do so by adjusting the slider to the desired amount.

As previously stated, leverage is limited to 100x. The user may then place the order by clicking “derivatives purchase” or “derivatives sell.”

The minimum equity share or initial margin required for leveraged contracts is set at 1%. Collateral must equal at least 1% of the intended position. Due to the 100x leverage available, a Derivative Wallet carrying 100 USDT may create a trade worth 10,000 USDT.